How to Budget for Festive Seasons Without Overspending

If you always overspend during holidays, you’re not alone. Learning how to Budget for Festive Seasons can help you enjoy Raya, CNY, Deepavali, Christmas, or year-end holidays without debt, guilt, or financial stress. With smart planning, you can still celebrate meaningfully — just without the painful credit card bill later.

Festive joy should not become a financial burden. Below is your complete guide to Budget for Festive Seasons the smart way.

🎯 Why You Need a Budget for Festive Seasons

Festivals come with predictable expenses:

- Gifts and angpao

- New clothes

- Travel or balik kampung

- Food and celebrations

- House cleaning or decorations

What is the biggest expense people forget to budget for during festive seasons? (Answer: travel, gifts, and last-minute shopping

💡 Step 1 — Set a Festive Spending Limit

To Budget for Festive Seasons, start with a clear spending cap.

Allocate based on your monthly income. A good rule:

| Category | Recommended % |

|---|---|

| Gifts/Angpao | 30% |

| Food | 25% |

| Travel | 25% |

| Clothes | 10% |

| Misc | 10% |

💡 Step 2 — Create a Festive Savings Plan

The earlier you save, the less it hurts. Even RM50–RM150/month spread over 10 months can fully cover Raya or CNY.

✅ Use a dedicated festive savings method — like a physical savings planner or separate envelope for MAE, BigPay, or TNG Pocket — to track and save intentionally each month.

💡 Step 3 — Track Every Ringgit

To Budget for Festive Seasons, tracking is non-negotiable.

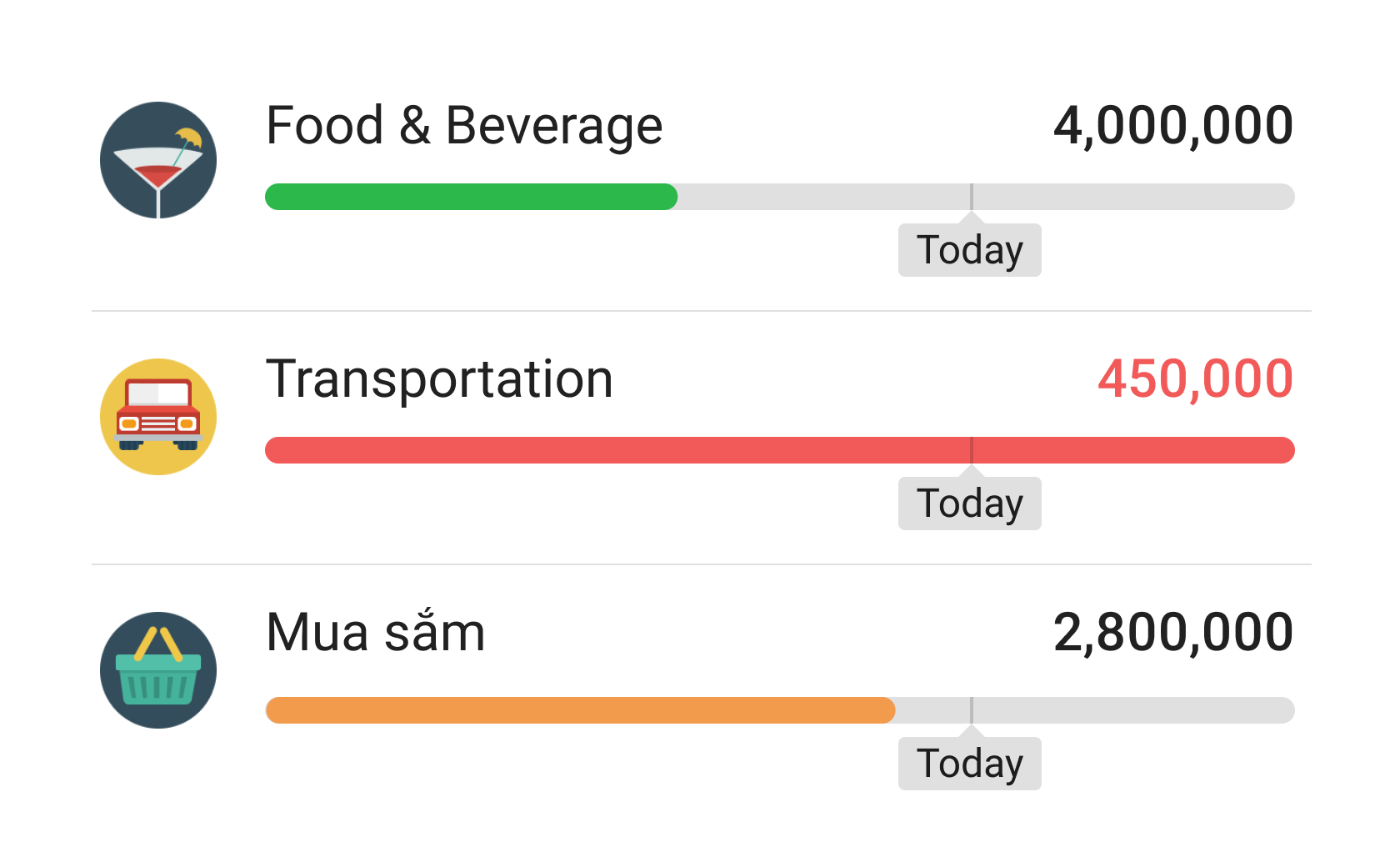

Use free apps:

- Spendee

- Money Lover

- MAE Expenses

Featured snippet question:

What is the easiest way to track festive spending?

Answer: Use an app and categorize expenses weekly.

💡 Step 4 — Avoid Last-Minute Shopping

This is where overspending happens.

Plan what you’ll buy before the festive month starts.

✅ Tip: Use a Festive Shopping Checklist (you can offer as download later)

💡 Step 5 — Use Cashback, Vouchers, and Price Tracking

This lowers cost without lowering joy.

Best tools:

- ShopBack

- GrabPay / TNG eWallet

- Shopee & Lazada voucher stacking

💡 Step 6 — Set Angpao or Gift Limits

Overspending on gifting is the #1 festive trap.

Examples:

- Max RM10–20 per child

- Fixed limit for relatives

💡 Step 7 — Learn to Say No

Festive FOMO drains wallets. You don’t need to attend every makan, holiday, or group gift.

Conclusion

To Budget for Festive Seasons, you don’t need to be stingy — just intentional. With a spending cap, savings plan, and tracking habits, you can celebrate meaningfully without overspending. Start planning now, and enjoy your festive season stress-free.

Post Comment