Why an Emergency Fund is More Important Than Investments

When it comes to personal finance, many Malaysians rush to invest, thinking it’s the fastest way to grow wealth. But before buying stocks or unit trusts, there’s one financial step you shouldn’t skip: building an emergency fund. Without it, unexpected expenses can derail your investments and even push you into debt.

In this guide, we’ll explain why an emergency fund is essential, how to build one, and why it takes priority over investing—even in 2025.

What is an Emergency Fund?

An emergency fund is money set aside to cover unexpected expenses, such as medical bills, car repairs, or sudden job loss.

- Purpose: Acts as a financial safety net.

- Recommended size: Typically 3–6 months of living expenses.

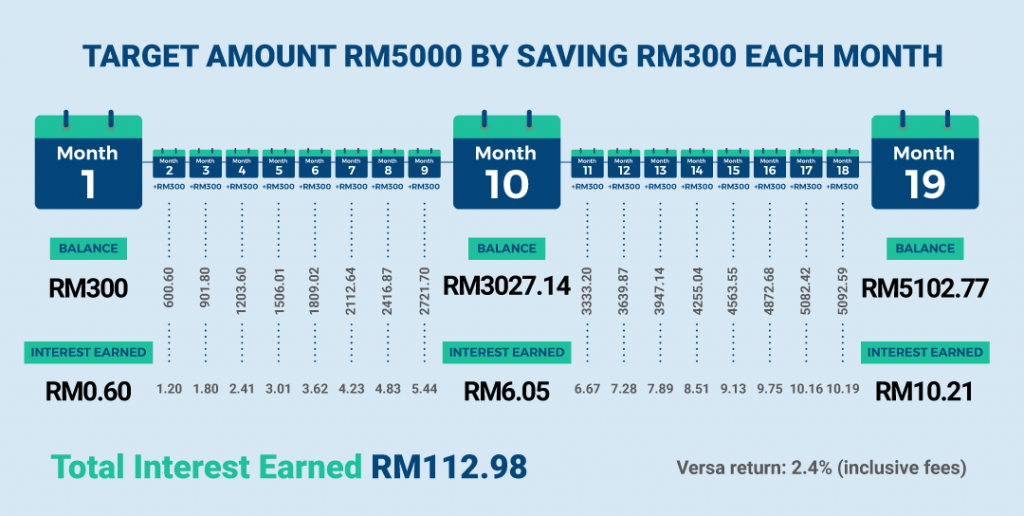

- Where to keep it: A high-interest savings account or money market fund, where funds are easily accessible.

Do you have funds set aside for sudden emergencies, or do you rely on credit cards and loans?

Why an Emergency Fund Comes Before Investments

Many Malaysians make the mistake of investing before securing a safety net. Here’s why that can backfire:

1. Protects Against Debt

Without an emergency fund, a sudden expense can force you to borrow money at high interest. By having cash ready, you avoid debt that can negate investment gains.

2. Prevents Panic Selling

Investments fluctuate in value. If a financial emergency arises, you might have to sell your investments at a loss. An emergency fund ensures you don’t touch your long-term assets.

3. Provides Peace of Mind

Knowing you have a safety net reduces stress and helps you make better financial decisions.

How Much Should Malaysians Save?

The amount depends on your monthly expenses. A common approach:

- 3 months of expenses: Minimum safety net.

- 6 months of expenses: Ideal for job security and unforeseen emergencies.

- High-risk jobs: Consider saving up to 12 months.

Tip: Start small. Even RM500 per month builds a meaningful fund over time.

How to Save RM10,000 in a Year

Where to Keep Your Emergency Fund

Accessibility is key. Avoid tying up your emergency fund in volatile investments. Consider:

- High-interest savings accounts – Low risk, instant access.

- Money market funds – Slightly higher returns, still liquid.

- Fixed deposits with short tenures – Only if you have secondary access funds.

Pro Tip: Track your emergency fund separately from your investment portfolio.

When to Start Investing

Once your emergency fund is in place:

- Set financial goals (retirement, home, education).

- Allocate extra savings to investments such as unit trusts, ETFs, or stocks.

- Review regularly and increase both your emergency fund and investments as income grows.

Common Mistakes to Avoid

- Using your emergency fund for non-urgent purchases.

- Investing before reaching your emergency fund goal.

- Keeping the fund in a low-interest account with negligible growth.

Conclusion

An emergency fund is the cornerstone of financial security. Before investing in stocks, bonds, or unit trusts, make sure you have a safety net to protect your finances. In Malaysia, where unexpected expenses are inevitable, prioritizing an emergency fund is not just smart—it’s essential.

Post Comment